A Brighter Roadmap for a Brighter Future

Our Roadmap is designed to help you fulfill your stewardship and illuminate the path that best enables you to realize your dreams. Backed by your Brighter Retirement Roadmap™ you’ll be able to make wise decisions about when and how start your retirement. Ensuring that your Income, Investment Growth, Taxes, Legacy and HealthCare needs have all been optimized and addressed.

How We Help

Income Maximization

The #1 concern of retirees today is the possibility of outliving their money.

Nowadays, people are living longer than ever before. It’s important to partner with a team that recognizes the structural differences of life phases; accumulation vs distribution. Proper income planning can help you feel more confident your money will be there when you need it.

Foundational resources for maximizing your retirement income include your Social Security Benefits and Pension Benefits. However, powerful supplemental resources might include; rental income, earned interest income from stocks/bonds/CDs, portfolio withdrawals, reverse mortgage income or annuity income.

Come see how the Brighter Retirement Roadmap™ Planning Process can help you maximize your retirement income for life.

Growth Optimization

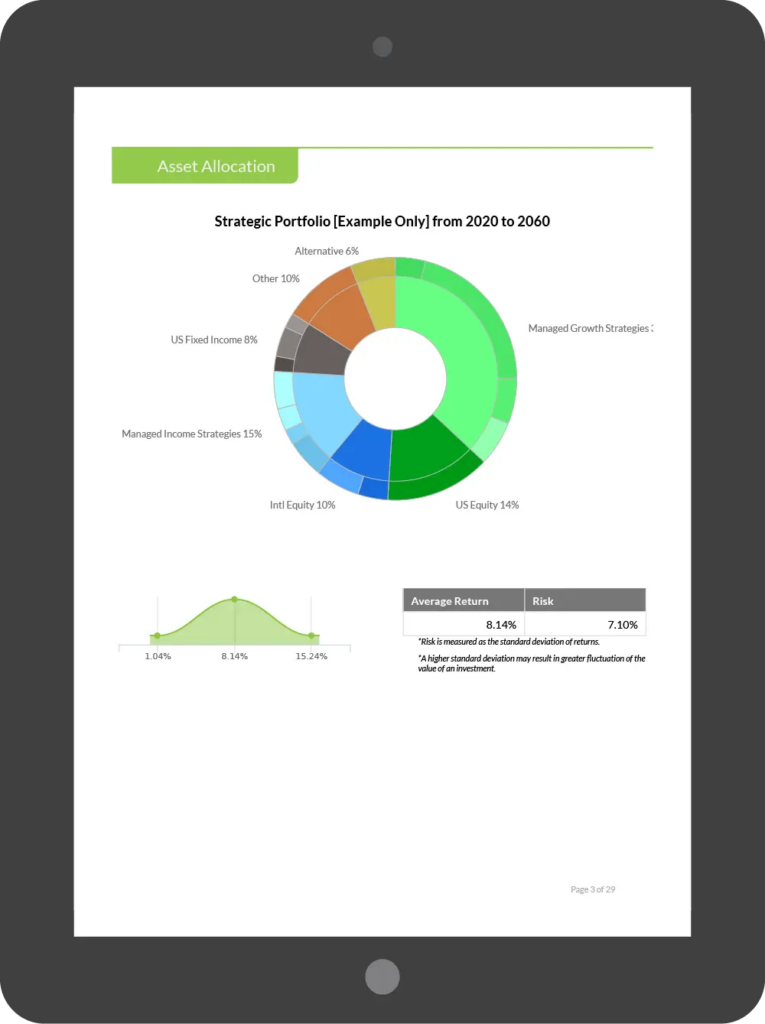

Investment decisions based on proven academic research, not emotions, automatically selects ideal positions geared towards reducing risk, fees, and taxes.

Our focus on conservative wealth management creates a client experience of custom tailored strategies & allocations that take into account their unique risk profile, investment objectives and tax qualification of their investments. In order to help preserve and grow wealth, our goal is to help avoid large market losses and shoot for consistency in various market cycles. Unique Separately Managed Accounts (SMAs), Bond Ladders and tactically managed portfolios equip our team to accomplish your investment goals.

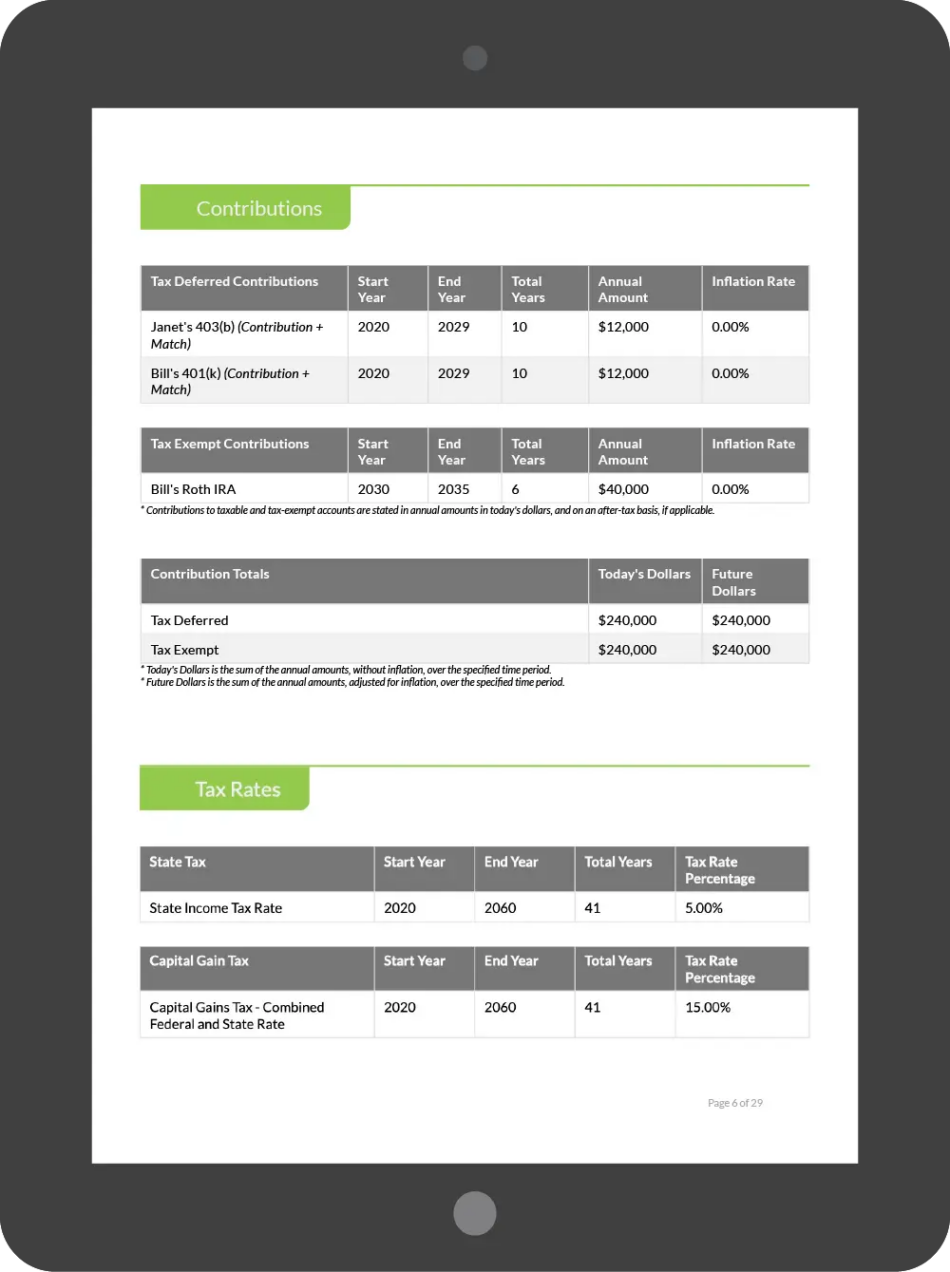

Tax Reduction

“A Penny Saved is a Penny Earned”

Portfolio earnings are best when paired with tax savings. Both are needed to optimize and create a smart retirement plan.

Unique to Brighter Wealth is our ability to simplify complicated decisions so that you can make informed and understood decisions. Tax Planning is notoriously complicated and so we simplify this conversation through a simple tool called, “Tax Story”. This one page tool will enable you to see your tax brackets.

Healthcare Planning

Similar to Estate Planning there is tendency to think of Healthcare planning as only just Medicare and Healthcare Insurance. However, the financial aspect of healthcare planning is vital for a healthy retirement plan. Brighter Retirement will look forward into your future retirement years and plan for the inevitable increasing expenses of assisted living care, nursing home care or memory care. Your Brighter Retirement Roadmap™ will address these potential costs and coordinate your assets to fund these needs in the most efficient way possible.

Legacy Planning

Legacy/Estate Planning is often thought of only in terms of the legal aspect of an attorney writing up a will, trust, power of attorney, health care directives, etc… but there is much more here for you to consider. For example, would you rather inherit a 1MM 401k or a 1MM Roth IRA? Well the 1MM Roth owes no taxes so you’d much rather that one. So Estate planning from the financial aspect is important so you can intentionally pass on to your estate (heirs) the most valuable assets possible. Also, how much Long-term care or health care expenses you might incur during retirement could decimate your estate’s value. Brighter Retirement will help you plan for those unexpected expenses and protect your legacy.